Then when you get paid again or get a big chunk of money, you decide what categories need funding during the period prior to your next inflow of cash.Īs you go, there will be times when you have to move money around among categories.

You start with the money you have in your account(s), dividing it between spending, debt, and savings. Every dollar should be assigned to either a spending category or savings so that at the end of the pay period, there’s no money left over. YNAB starts with your income and asks you to give every dollar a job. In addition, the company has multiple security types, including two-step verification. YNAB is not a fly-by-night company it's been around since 2004. It uses bank-grade or better encryption, and it does not store your bank credentials. The policy is strong, especially the part about completely deleting your account should you leave the service (some personal finance sites let your data hang around for a time even after you’ve stopped using them).

#YOU NEED A BUDGET MAC FULL#

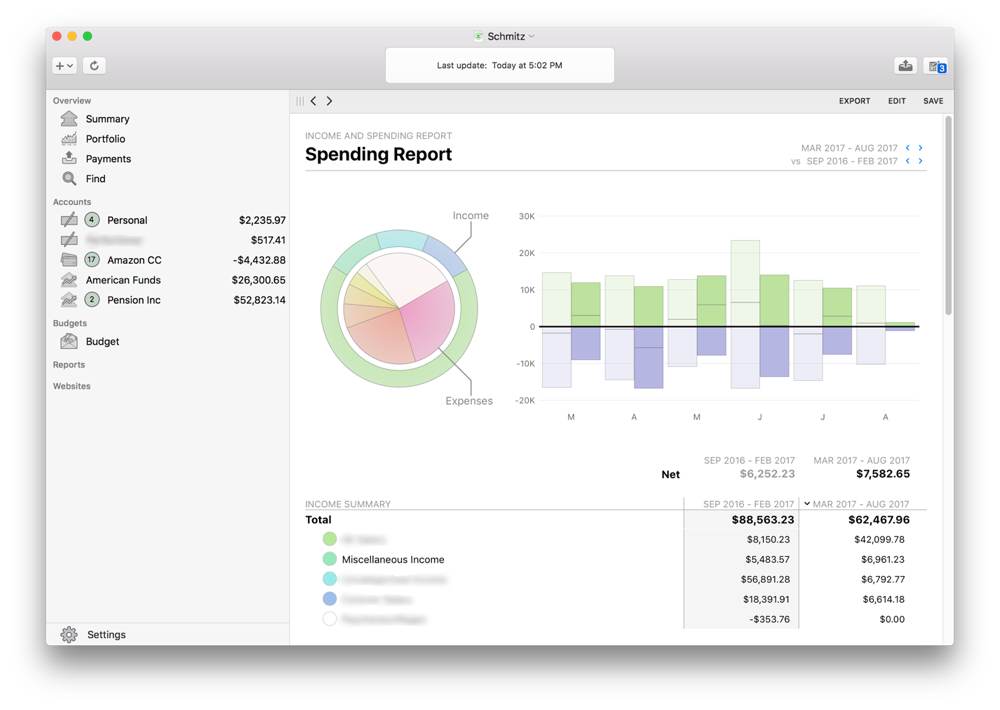

YNAB, like the other personal finance services I've reviewed, promises to keep your information encrypted and secure and makes its full security policy (Opens in a new window) publicly available. (Opens in a new window) Read Our WalletHub Review In fact, it can be a good adjunct to Mint or Quicken Deluxe if you're serious about controlling your budget. Still, if you want a more innovative method of budgeting that helps you balance your monthly budget rather than just comparing budgeted amounts to actual income and spending, then YNAB is an excellent choice. And Quicken Deluxe, another Editors’ Choice winner, costs about half as much as YNAB when paying annually. Other personal finance applications, such as Editors' Choice Mint and Credit Karma, are free. In addition to its learning curve, YNAB is more expensive than most competitors. Used conscientiously, YNAB improves your chances of making a budget work by helping you understand your saving and spending habits better. YNAB can be difficult to master, but it provides many educational materials, both tutorial and philosophical. The site connects directly to your financial accounts to pull in balances and transactions that flow directly into your budget, so you can instantly see where you stand with your spending. This online personal finance software is built on the philosophy that every dollar you're projected to earn needs a job, so you assign it to either be spent or saved. YNAB, which stands for You Need a Budget, takes an unusual approach to personal budgeting.

#YOU NEED A BUDGET MAC HOW TO#

How to Set Up Two-Factor Authentication.How to Record the Screen on Your Windows PC or Mac.How to Convert YouTube Videos to MP3 Files.How to Save Money on Your Cell Phone Bill.How to Free Up Space on Your iPhone or iPad.How to Block Robotexts and Spam Messages.

0 kommentar(er)

0 kommentar(er)